For the trade, the announcement was as stunning as it was historic. Last week the Oppenheimer family announced it has sold its 40 percent stake in De Beers to Anglo American for $5.1 billion. The sale gives Anglo American 85% control of De Beers with the government of Botswana holding the remaining 15%. The sales ends the Oppenheimer family’s 85-year control of the giant diamond company.

For the trade, the announcement was as stunning as it was historic. Last week the Oppenheimer family announced it has sold its 40 percent stake in De Beers to Anglo American for $5.1 billion. The sale gives Anglo American 85% control of De Beers with the government of Botswana holding the remaining 15%. The sales ends the Oppenheimer family’s 85-year control of the giant diamond company.

Ernest Oppenheimer, later Sir Ernest Oppenheimer, was a diamond trader with a British company in South Africa when World War I broke out. Sensing opportunity, he organized the Anglo American Corporation of South Africa (yes, the same company which has bought De Beers used to be a sister company). The Anglo American Corporation and later the Oppenheimer Consolidated Diamond Mines company were the vehicles he used to acquire German gold and diamond holdings. The Germans were fearful that if they lost the war, their holdings would be confiscated anyway. As a result, they traded their properties for stock in the newly created companies.

De Beers had been an independent diamond company, founded by two Afrikaner brothers and the object of an epic struggle between Barney Barnato and Cecil Rhodes and Charles Rudd, one which Cecil Rhodes eventually won. By 1902, De Beers controlled 90% of the world’s diamond production.

After WWI, in 1926, Ernest Oppenheimer bought a seat on the board of De Beers and the next year 1927 assumed chairmanship of the company.

After WWI, in 1926, Ernest Oppenheimer bought a seat on the board of De Beers and the next year 1927 assumed chairmanship of the company.

In the 1930s as world demand for diamonds weakened in the Great Depression, Oppenheimer created the business model that would define diamond distribution and prices for the balance of the 20th century. He called it “single channel marketing” and defined it as “a producers’ co-operative including the major outside, or non-De Beers producers in accordance with the belief that only by limiting the quantity of diamonds put on the market, in accordance with the demand, and by selling through one channel, can the stability of the diamond trade be maintained.”

This was the cartel. Diamond producers had to join the cartel or see the world market flooded with diamonds similar to those they were producing. (This of course would result in prices for those diamonds crashing.) De Beers also limited the supply of certain diamonds to keep prices stable. The cartel held an iron grip on the diamond market until 2000 when a number of diamond producers in Australia, Russia and Canada made the then risky decision to sell outside the De Beers channel.

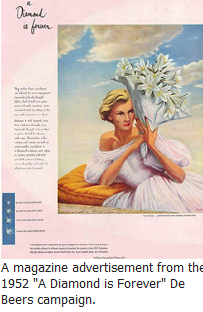

It was also under the leadership of Ernest Oppenheimer that De Beers created one of the most, if not the most, successful advertising campaign in advertising history. The “A Diamond is Forever” campaign, created by a copywriter with N.W. Ayers, an advertising company, and launched in 1947 changed forever the perception of diamonds. Not so incidentally, the campaign also virtually destroyed the secondary market for diamonds as couples now saw them as heirlooms to be kept within the family.

It was also under the leadership of Ernest Oppenheimer that De Beers created one of the most, if not the most, successful advertising campaign in advertising history. The “A Diamond is Forever” campaign, created by a copywriter with N.W. Ayers, an advertising company, and launched in 1947 changed forever the perception of diamonds. Not so incidentally, the campaign also virtually destroyed the secondary market for diamonds as couples now saw them as heirlooms to be kept within the family.

Ernest Oppenheimer died in 1957. His grandson, Nicky Oppenheimer, became chairman of De Beers in 1998 after the retirement of his father, Harry Oppenheimer.

Contrary to trade speculation that the deal was months in the making, Nicky Oppenheimer claimed in a Mineweb interview that the possibility was raised on three and a half weeks before the announcement of the sale.

So, what impact will the sale have?

Anglo American says its first order of business is to meet surging demand in new markets. A company spokesman says that “In 2005, India and China represented about 8 percent of demand. By 2015, India, China and the Gulf will represent about close to 40 percent.”

Others hope for a new business model. Bloomberg News quotes Charles Wyndham, a former De Beers sales director and founder of WWW International Diamond Consultants, Ltd., “I hope it will be liberating,” he says. “Hopefully they will move away from the old business model, treat diamonds as the commodity they are, and get down to being a proper business rather than a ghastly little club.”

I wouldn’t bet the ranch on this.